Dec. 13, 2024,

I had 40 SHOP contracts (strike 60), due to exp on 1/17/25. SHOP price has gone up quite a bit at ~$115/sh. I put in an order to buy back the short calls and sell more calls at a higher strike price, for a credit trade (i.e., generating some income for me). I wanted to raise the strike from $60 to $70, which is still deep in the money (i.e., quite safe). The only qualifiable trade is for call options exp. 1/15/2027, 2 years out. A brief calculation shows this trade would give me >30% annualized return. And this trade is extremely safe, although boring (Nothing for me to do with this for 2 years). I can live with a safe investment of 30% return/yr, so I did it.

The order was executed and brought in extra trading cash, which I can put in to work, making more money for me.

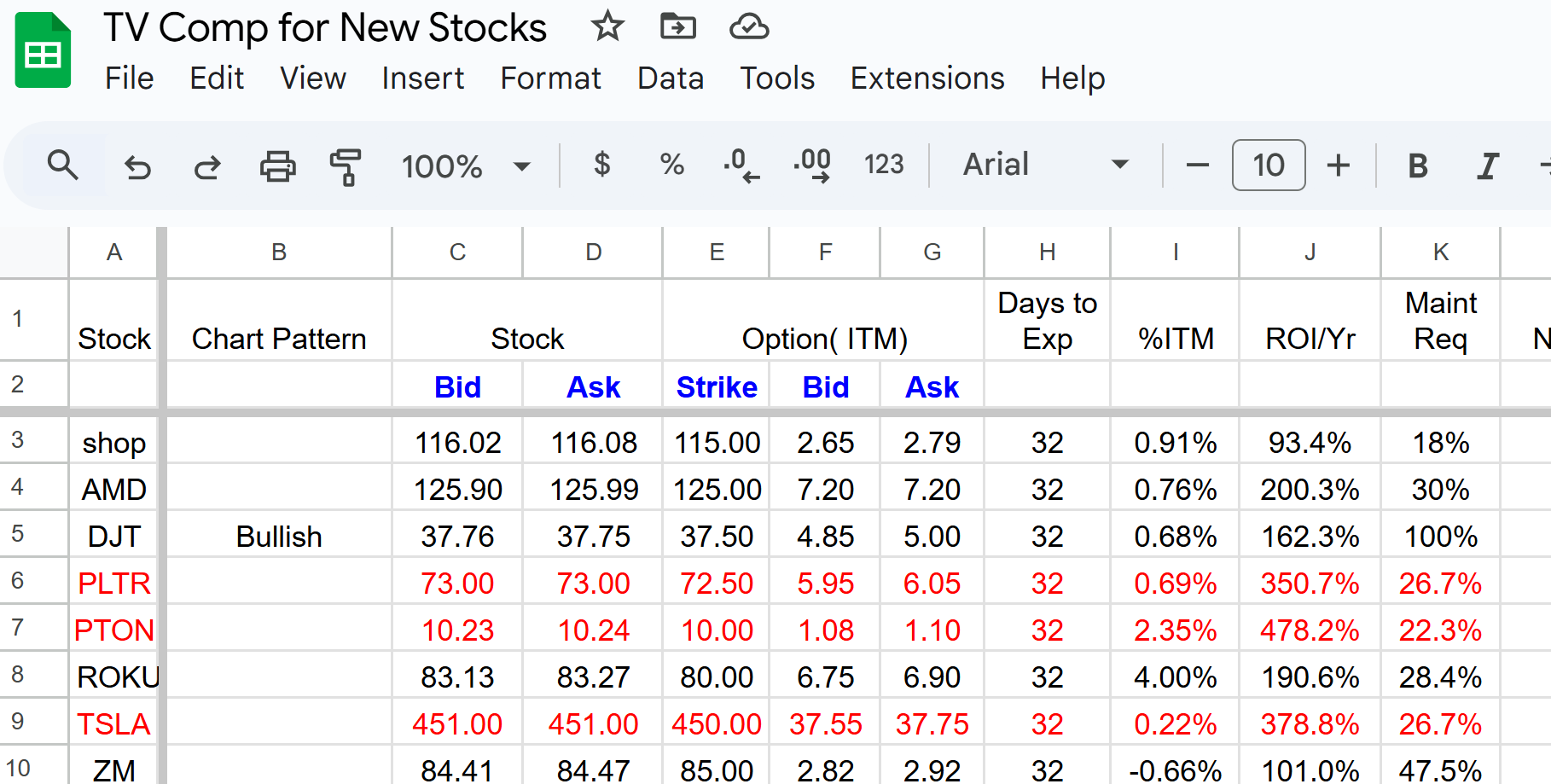

What to trade? Out of the stocks I own (table below), I chose TSLA and PTON, simply because they give me better annualized returns.

1. TSLA: It is a simple math problem. With the extra trading powder, I bought 200 shares of TSLA and sold 2 contracts of TSLA $450 strike, exp 1/17/25 calls. Net price was $415.58/sh. In 32 days, if TSLA stays above $450, this trade will give me 450 – 413.58 = $7,284, minus some transaction fees and some margin interest.

2. PTON. Similarly, I bought 5000 shares of PTON and sold 50 contracts of $10, exp. 1/17/25. The net cost was $9.1/sh. This trade could bring me $0.9 x 5000 = $4,500/32 days.