Both websites are painting a similar picture: while the last week’s market movements is positive, the indexes are still within a trading range. Most of these indexes are approaching the higher end of the trading range, making it vulnerable for a pullback.

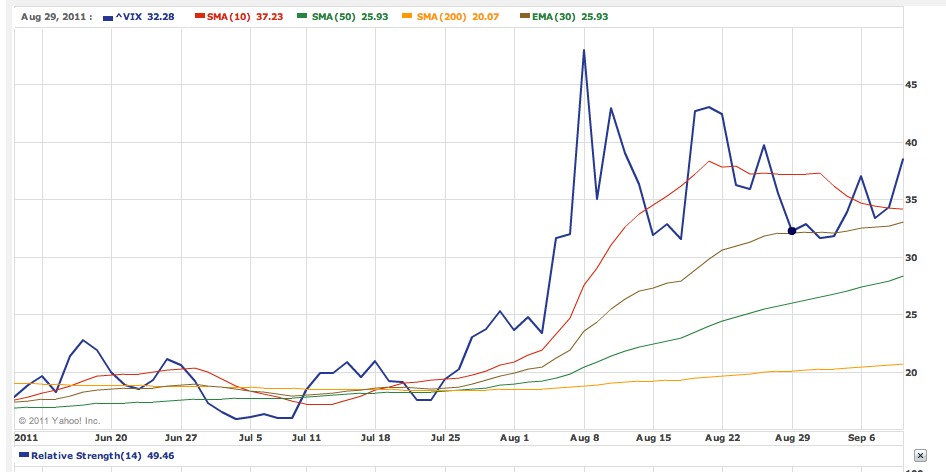

VIX: vix has been showing lower highs and it closed below 31 last Friday. The question is whether it will break below 30, a welcome trend for the bulls, or it will reverse, like in previous instances, to stay within the 31-4o channel.

My take: Market’s reaction to FOMC’s meeting on Wednesday is important to watch. The market is expecting some stimulus from the Feds. As the old adage goes, buy the rumor, sell the news. When the Feds announce its decision, there may be a market sell off, in the backdrop of recent market advances.

Levels to watch:

SPX: 1225

Comp: 2652

DJIA: 11577

VIX: 30