Account Performance

Note: after the initial 2 years of bull market, I have accumulated a nice portfolio. Since 2011, I began to change my approach to a safer and more steady growth rather than taking high risks aiming for high gains. Due to this change, my account performance tends to outperform S&P in years when the market is down or moderately up. I expect my account to slightly underperform S&P when market is strong like in 2013. interesting enough, I found my result may be similar to Warren Buffett’s. Warren Buffet’s performance is 18.2% in 2013. Mr. Buffett said “Berkshire’s book value and intrinsic value will outperform the S&P in years when the market is down or moderately up. We expect to fall short, though, in years when the market is strong – as we did in 2013,” USA Today). In a strong market, while my long stock positions go up in value, so are my short call positions (the former goes up more than the latter), therefore, my performance won’t be as high as a pure long stock account. However, the increase in both stock prices and the call option prices make my covered calls deeper in the money, which increases the safety level of my account. In the future years when the market becomes weak, the deep in the money call positions will gradually become less deep in the money, and yielding higher returns in the years to come.

- Overall account has increased 765% since 2008.

- 2014: 10.85% (SP500: 13.4%)

- 2013: up 27.43% (SP500: 29.6%) (Warren Buffet’s performance is 18.2% in 2013).

- 2012: up 13.7% (SP500 up 13.3%), while only 39% of professional money managers outperformed the SP500.

- 2011: up 11.6% (SP500 was flat at ~0%), while 79% of professional money managers did worse than SP500. (CNN.com)

- 2010: up 91.41% (SP500 up 12.64%)

- 2009: up 247.13% (SP500 up 23.49%).

Source: SP500 performance (http://en.wikipedia.org/wiki/S%26P_500).

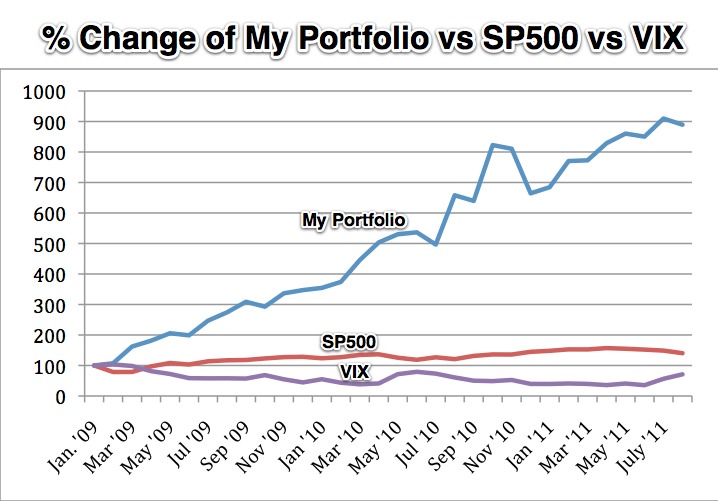

The above chart shows the change of my portfolio in relationship to SP500 and VIX between 1/1/09 and 8/31/11.

- My portfolio: 889% increase

- SP500: 140% increase

- VIX: Correlation between VIX and my portfolio performance is one research topic that I am interested in. This is because high VIX causes more rapid deterioration of option time value, hence a positive to my portfolio. But the higher the VIX, the greater the loss of my long stocks. I am learning to use VIX as one of the technicals to guide my investment (i.e., within a range, when VIX is high in a range, I go bullish, as it is now; but when VIX goes low I go bearish). I don’t see a significant correlation on the above chart yet, unfortunately.

The total return of my two trading accounts is up 33.87% so far this year, even after the awful gut-wrenching August! What did I do during the August crash? First of all, I didn’t sell any stocks. In fact, I even bought more stocks (wrote more covered calls). As a result, many of my stocks recovered and went above my call strike prices (such as bidu, pcln, mcp, slw, and lvs). Two of my stock holdings, crm and ffiv, have gone below my strike price. But CRM is now close to the strike price (strike is $130, and the stock is in 120s).

All in all, I didn’t lose much real value in my stock holdings. What’s lost is mostly the out of the money portion which doesn’t really hurt me anyways. Since January 2009, we have gone through several cycles of market downturns (“correction” or “flash crash” or whatever you call it). My results, once again, provide further evidence to support that my approach is a sound, money making strategy.

-updated 9/3/11.

My accounts is up by 15.7% (including the time values of the option positions that I have. For stocks like FFIV and CRM, I have options that are out of the money. These options show up on my accounts as negative. But they are out of money, therefore, these are definitely my money). I can say up to this point that my strategy has been weathering this market downturn pretty well. Remember, we are in August only. There are still many months that I can sell more options. But with more and more of my stocks out of money or at the money (PCLN), my protection is becoming smaller and smaller. I hope, as all the bulls out there, that the markets have seen the worst days this year. Good luck, bulls.

Updated 8/20/11

********************

My account is up by 25.8% this year until Aug. 5th (even after the 10% loss in SP500). This again shows the benefits of being disciplined and following your logic and reasoning, not knee jerk reactions.

How was I able to avoid the recent major crash with minimal damage? There is no trick to it. I have been holding these stocks for a very long time and the options (my hedge) of my covered call are deep in the money. I learned my lesson in the past: NOT to roll up the option strike prices too fast and too high, because markets will crash from time to time (actually it happens several times a year). I currently have BIDU (strike 105), CRM (strike 130), FFIV (strike 100), PCLN (strike 450), MCP (strike 50 and 55), LVS (strike 40), AND SLW (strike 33). All except FFIV are in the money, even after the recent big losses. It is very interesting to note that I rolled up PCLN’s strike very cautiously from 425 to 450 on 4/15/11, when PCLN was `$520/sh. Even with this deep in the money call, I was still able to sell an annualized time value about 45%. Now you see the reason I am so cautious and still make good money.

Updated: Aug 7th at 12 noon.

*****

I calculated the performance of my portfolio and adjusted it for deposits and withdrawals. Here is a brief summary.

2009: up by 247.13%

2010: up by 91.41%

2011: up by 11.6%

2012: up by 13.6%

Between Jan ’09 and July ’11: up by 810%.

I will draw some charts based on these numbers and I will update this performance regularly.

Updated on Aug. 4th, 2011

Serious follower of this page, a number of your articles or blog posts have seriously helped me out. Looking towards up-dates!

I actually learned about virtually all of this, but in spite of this, I still thought it had been helpful. Beautiful job!