Schaeffersresearch.com: “Our takeaway is that this is a market that has the proper sentiment backdrop for a major V-bottom, but the technical backdrop is not as supportive. So, in the absence of a catalyst, the pressure to unwind bearish bets or move from the sidelines is not as great.”

ChartAdvisor.com: “The bottom line is that the environment is still quite dangerous and traders should be ready for any scenario, including a second leg down.”

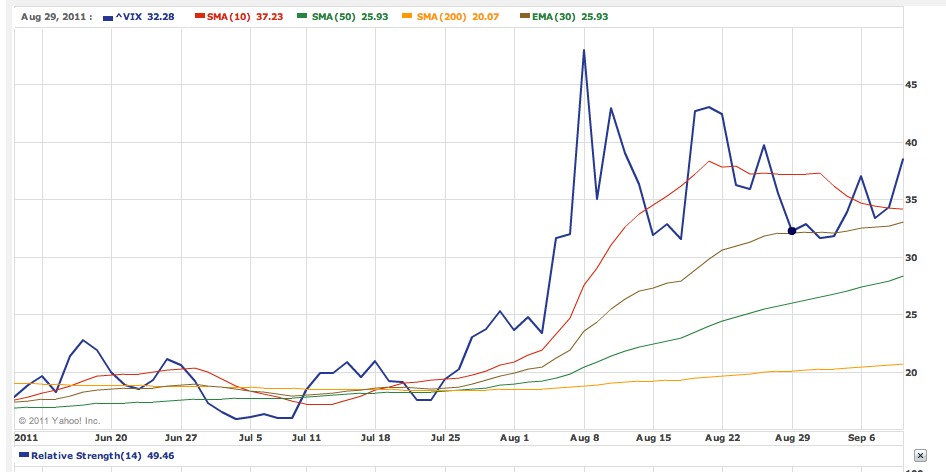

My take: the market is in a range bound trading which actually is a perfect setup for covered calls. The high VIX environment may seem scary, but actually is also good for option sellers (high volatility usually is correlated with higher options premiums or, in other words, high time values). As we are closer to the bottom of the trading range, I intend to go a bit bullish in my approach. For example, my NFLX options expired as of Friday. So now I am net long NFLX. With NFLX shares close to a near term bottom, I will wait for NFLX price to recover a bit before I sell more options against them.

The current Trading Range:

SP500: ~1140 – 1230

DJI: ~11,000 – 11,700

NASD: ~2480 – 2600